Feie Calculator Things To Know Before You Get This

Wiki Article

What Does Feie Calculator Do?

Table of ContentsThe Main Principles Of Feie Calculator The Definitive Guide to Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.The smart Trick of Feie Calculator That Nobody is Talking AboutSome Known Details About Feie Calculator

He marketed his United state home to establish his intent to live abroad permanently and used for a Mexican residency visa with his wife to aid meet the Bona Fide Residency Test. Additionally, Neil secured a long-term property lease in Mexico, with strategies to eventually acquire a home. "I presently have a six-month lease on a residence in Mexico that I can extend another 6 months, with the intent to purchase a home down there." Nonetheless, Neil explains that buying home abroad can be challenging without initial experiencing the place."We'll definitely be outside of that. Even if we return to the US for physician's appointments or organization phone calls, I question we'll invest more than 30 days in the United States in any kind of given 12-month period." Neil stresses the value of stringent monitoring of U.S. visits (Bona Fide Residency Test for FEIE). "It's something that individuals need to be truly diligent about," he states, and advises deportees to be cautious of common mistakes, such as overstaying in the U.S.

Our Feie Calculator Diaries

tax obligation commitments. "The reason U.S. taxation on worldwide income is such a big deal is because many people neglect they're still subject to U.S. tax obligation also after transferring." The united state is among the couple of countries that taxes its citizens no matter where they live, indicating that even if an expat has no earnings from united stateincome tax return. "The Foreign Tax Credit score permits people functioning in high-tax nations like the UK to offset their united state tax obligation responsibility by the quantity they've already paid in tax obligations abroad," says Lewis. This guarantees that expats are not strained twice on the same revenue. Nevertheless, those in low- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The Ultimate Guide To Feie Calculator

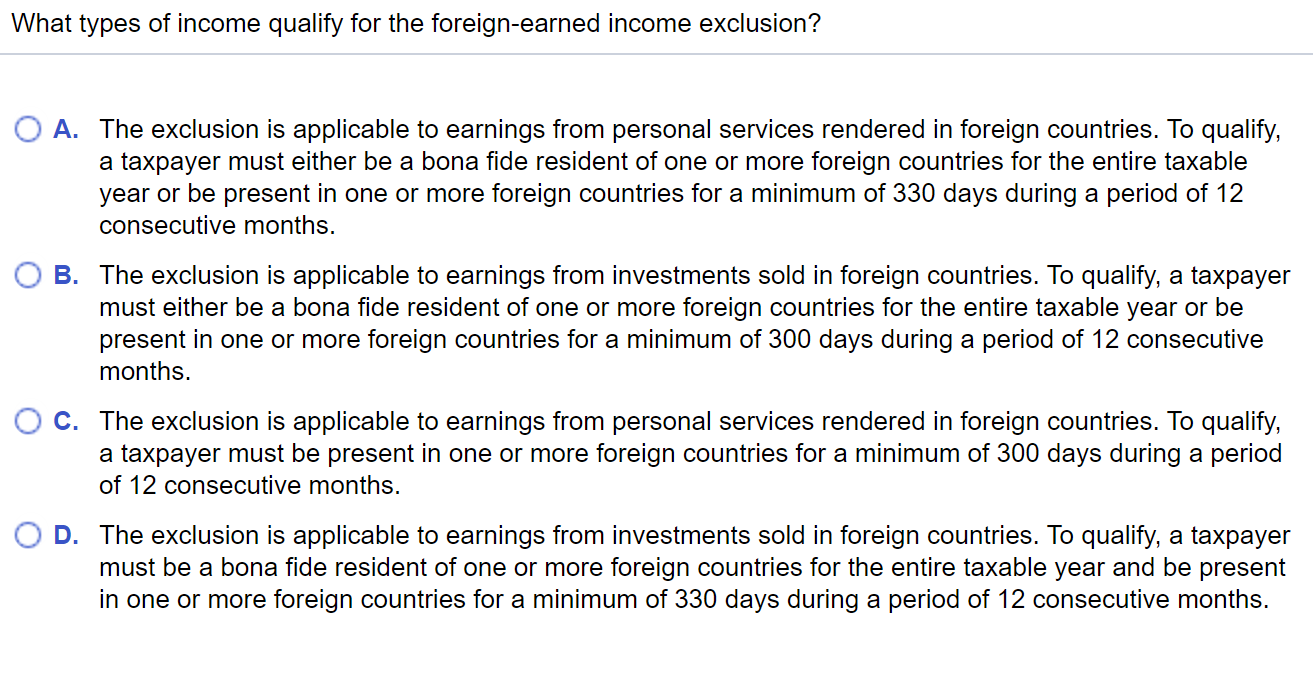

Below are some of the most regularly asked questions regarding the FEIE and various other exemptions The International Earned Earnings Exclusion (FEIE) permits united state taxpayers to leave out up to $130,000 of foreign-earned revenue from federal revenue tax, minimizing their united state tax obligation. To certify for FEIE, you need to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Residence Examination (confirm your key house in an international country for a whole tax obligation year).

The Physical Existence Test also calls for U.S (Bona Fide Residency Test for FEIE). taxpayers to have both an international revenue and an international tax home.

The Definitive Guide for Feie Calculator

A revenue tax treaty between the the original source U.S. and another nation can help stop dual tax. While the Foreign Earned Revenue Exclusion decreases gross income, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Record) is a required filing for united state residents with over $10,000 in international financial accounts.Qualification for FEIE depends on conference specific residency or physical existence examinations. is a tax obligation advisor on the Harness platform and the founder of Chessis Tax obligation. He belongs to the National Organization of Enrolled Representatives, the Texas Culture of Enrolled Agents, and the Texas Society of CPAs. He brings over a decade of experience working for Huge 4 companies, recommending migrants and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the owner of The Tax obligation Guy. He has over thirty years of experience and now concentrates on CFO solutions, equity compensation, copyright taxes, cannabis taxation and divorce related tax/financial planning issues. He is a deportee based in Mexico - https://freeseolink.org/FEIE-Calculator_382037.html.

The foreign gained earnings exclusions, sometimes described as the Sec. 911 exclusions, omit tax on incomes made from functioning abroad. The exemptions consist of 2 parts - a revenue exclusion and a real estate exclusion. The adhering to Frequently asked questions talk about the advantage of the exclusions consisting of when both partners are expats in a basic fashion.

Feie Calculator Things To Know Before You Buy

The income exemption is now indexed for rising cost of living. The maximum annual income exclusion is $130,000 for 2025. The tax benefit leaves out the income from tax at bottom tax rates. Previously, the exemptions "came off the top" decreasing earnings topic to tax obligation on top tax obligation prices. The exclusions may or might not lower income used for various other objectives, such as individual retirement account restrictions, youngster credits, personal exemptions, etc.These exclusions do not exempt the salaries from US taxes yet simply offer a tax reduction. Note that a bachelor working abroad for all of 2025 that gained concerning $145,000 without other income will certainly have taxable earnings minimized to no - successfully the exact same answer as being "free of tax." The exclusions are calculated on a day-to-day basis.

Report this wiki page